We partner with some awesome companies that offer products which can help our readers. If you make a purchase through one of our partner links, we may receive a commission at absolutely no additional cost to you! Please see my Policy & Disclosure page for full details.

It’s been 24 months since we got serious about paying off our $127,229 worth of debt. We officially broke the 6 figure mark by paying off $100,479 so far!

Woot woot! *Hands in the air*

This month we decided to make a large lump sum payment towards my student loan, $10,000 to be exact.

You may be wondering where in the world did we get this money?

It was mainly from our emergency fund.

If you’re ready to start on your own debt free journey and start knocking out some debt easily then grab the free debt thermometer and enroll in the 5-day Debt Free Bootcamp.

Knowing when to take money out the emergency fund

Prior to Covid, we were paying around $1,600 diligently towards out debt. That all came to a screeching halt once the pandemic rolled around.

To be on the safe side, we were saving a lot of the money plus there was no real urgency to pay off the student loan and personal loan from family due to 0% interest.

You may also be wondering why in the world would I pay down debt when there’s 0% interest?

When a debt item has 0% interest, that means 100% of your payment goes towards knocking out the principal instead of any of it going towards interest.

Basically, your money goes a lot further when you’re paying something off with 0% interest.

Now, being more than 6 months down the road since Covid we felt it was alright to let go of a portion of the emergency fund.

Sometimes having too much in the fund doesn’t do any good for ya.

Everyone’s situation will be different.

Generally, try to stick with an emergency fund of 3-6 months and keep it in a high yield savings account. Anything more than that, you’re probably better off paying down debt or investing.

Read More: 5 Tips to Build Your Emergency Fund Fast

Put your money in a High Yield APR Savings Account from Nationwide / Axos Bank. They’re offering 1.05% of interest which is the highest around. Sign up here at Nationwide / Axos Bank to lock in that rate.

Enjoy life while paying off debt

I’m ALL for reaching your goals without being miserable.

Getting out of debt doesn’t mean you can’t have fun. Forget everything you’ve heard about people who don’t go on vacations or enjoy their life while getting out of debt.

That’s not the way I want to live my life and I’m sure that’s not how you want to live either.

Why? Cause you only get 1 life, so you should enjoy it!

Yeah, you’re probably thinking we may have enjoyed ours a little too much, winding up in over $120,000 of debt. Oops!

Anyway, we’re fixing it now, that’s all that matters.

So, we’ve figured out how to travel for free.

Once we paid off our credit cards, our credit scores naturally shot up!

Mine’s at 836 now.

That meant we were able to get awesome travel reward cards.

Read More: 15 Tips to Get Your Credit Score to 800’s

If you want to travel for free, apply for reward cards once your credit is good (generally 700 and up), check what your credit score is for free at Credit Karma.

Important Tip: Instead of using multiple cards, use only 1 for all your bills, that way you won’t rack up too much debt. Also, apply for 1 reward card at a time so you don’t spread yourself thin with all these cards.

This month we went on a small trip to Six Flags, and stayed at a Marriott for 2 nights (free with our Capital One Venture Card).

We love the Capital One Venture Card, we nearly racked up 160,056 worth of points which is simply equal to $1,606.

How did we get so many points?

My husband applied for one when they offered a promotion of 70,000 points then after we redeemed all those points, I signed up for one and received 50,000 bonus points. The rest of the points came from regular purchases.

One thing to keep in mind when getting these reward cards is that they will offer huge bonus points but only if you spend a certain amount.

For instance, with Capital One Venture, they offer 50,000 if you spend $3,000 within 3 months or 100,000 points if you spend $20,000 in 12 months.

It’s easy to meet that spending requirement if you put all your bills and expenses on 1 single card. That’s what we do.

Check to see if you qualify for the Capital One Venture Card to get free travel.

We went from having 8 credit cards with over $30,000 in credit card debt and now we use only 1 for all expenses and pay it off in full each month.

That’s the key to improving your credit and to have credit cards work for you instead of against you.

Getting out of debt, especially high interest credit card debt, is one of the most important things my husband and I did. It freed up so much of our money, our credit scores improved, and we received up to 520,000 = $5,200 worth of rewards bonus points.

Turn things around, make the credit card companies earn your business, get out of debt while traveling and having fun too.

Read More:

How to Get Out of Debt with these 5 Tips

Las Vegas Trip on a Budget with Free Flights

How to Spend only $200 on a 5 Night Cruise to Mexico

Use Rakuten to Book Travel

Prior to any booking of a trip, I always check out Rakuten to see if there’s any cash back offers.

Luckily, they were offering 3.5% cash back for our Marriott stay. I should expect to see around $6 back from going through Rakuten on to Orbitz.

Another bonus is when you book with Orbitz, you’ll get something called Orbucks which is their own cash back program. We’re getting back $5.34 for our stay at Marriott.

So in total, we got the Marriott stay for $196.37 for free with the Capital One Venture Card, also we’re getting back $6 from Rakuten and $5.34 from Orbitz.

It may not be much but it’s still something, we’ll have $11 more bucks to claim instead of losing out on free money.

Sign up is free and my special link here will get you a $10 welcome bonus + $30 cash back when you spend $30 (It’s like getting $30 for free!) Rakuten won’t disappoint, check them out.

Still using cash back apps

I don’t know about you but I looove getting free money.

I’m still using cash back apps to make every hard earned dollar work for me. What’s even better is I don’t have to put in too much effort to get some extra cash back.

Last month I told you guys that I’m using Ibotta, Fetchrewards, Receiptpal, Rakuten, and Honey. This month I’ve used Groupon and Getupside in addition to those other cashback tools.

Find the best deals on services with Groupon

I use Groupon to get the best deals for local businesses. This month I found a great deal for an oil change on Groupon.

There’s a lot of oil change places around me but a lot of them charge over $30 just for my small car. So instead of settling for the $30, I went on Groupon and found an oil change place less than 5 minutes away and paid only $21 with taxes and everything.

Groupon is so easy to use. First you can go on their website and type in whatever service you’re looking for.

They have any local business you can think of from oil changes, beauty, spa, tickets to events, laser hair removal, and so much more. When you find the perfect deal, you’ll purchase it through Groupon and print out your voucher. Then you can bring the voucher to the store/shop and have them scan it, get your service done, and you’re out. Easy Peasy.

If you can find the service you’re looking to get for much cheaper on Groupon, why not take advantage of the savings?

Sign up for free here and start to save that money $$

Get money back at the pump with Getupside

Getupside is another app I started using. It gives you cash back when you get gas or get food.

You can get up to .15 cents back for each gallon or up to 15% off food.

Let’s say you pumped about 16 gallons worth of gas, you can get back $2.40 cash back with .15 cents back per gallon. All you have to do is choose the gas station you’re planning to pump at and scan your receipt. It’s super easy to use.

Once you reach $10 then you can get a free gift card. There’s nothing better then getting money back for something you’d normally be buying anyway.

Get your .15 cents off per gallon and up to 15% off food with this link for Getupside

Making some money by playing games on Swagbucks

When I wind down for the night, I watch TV for a couple of hours in the evening with the hubby. I’ll take my phone out and start playing some games through Swagbucks. They offer good amount of points just for playing games.

Recently I earned 500 swagbucks = $5 just for playing one of their games. Currently, I’m in the process of playing 2 of their other games.

Now, I’ve reached over 2134 swagbucks which is equal to $21.34. I could probably cash that in to get a full tank of gas but I want to wait till it builds a lot more. But hey, that ain’t bad for doing something solely while I’m bumming around watching TV.

Sign up for Swagbucks to start earning some cash / gift cards and get your $10 welcome bonus

Automate your savings with Honey

Remember when I told you that I always look for cash back opportunities when I shop online via Rakuten or Swagbucks? Well, what do you do when those sites don’t offer any cash back?

For instance, this month I bought an adjustable bed frame on Amazon. I checked Rakuten and Swagbucks to see if there were any cash back offers for the bed frame. Unfortunately, this month they didn’t have any deals. I decided to buy the bed frame anyway. As I was checking out, my Honey chrome extension kicked on and found a coupon code for me for $20 off. I was happy about that!

The best part was, I didn’t have to do any searching to get the deal on the bed frame from Amazon, it was all automatic. I highly recommend signing up for Honey to get automated coupons applied for your online purchases. Honey also gets you something called Honey Gold which is a cash back bonus program.

You could earn as much as 1%-20% cash back when you shop online or 300 – 300000 Honey Gold back.

All you need to do is download the Honey chrome extension for free and it does all the savings for you automatically, you don’t need to go fishing around for deals online.

Sign up for free here and get the cheapest prices for all your online purchases instantly and hassle free

Earn cash simply by uploading receipts

If you’ve been following my other debt free journey reports, I mentioned that I earn points which convert to cash or gift cards simply by uploading receipts.

Receiptpal

This month, I earned enough points on Receiptpal to earn a $5 gift card, which is awesome. Why was it awesome you ask? Cause it was free money! That’s enough to get myself a free $5 Amazon gift card. All I did was scan some receipts, that’s all.

Try it out, instead of throwing your receipts in the trash, save them and scan it for points. Those points will get you free Amazon gift cards.

I literally uploaded any receipt I get, from store receipts, restaurant receipts, gas receipts, oil change receipts, and more.

Sign up for free here and start getting money back for your receipts

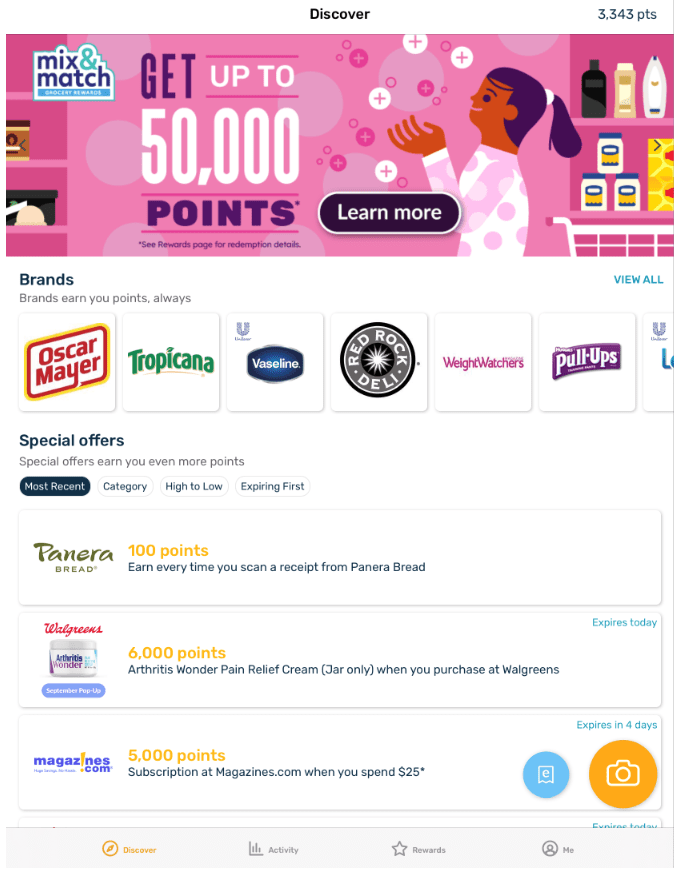

Fetch Rewards

With the same receipts I used for Receiptpal, it can also be used for Fetch Rewards. Double whammy!

The only thing is, for Fetch Rewards you’ll probably get a lot more points for grocery receipts. You’ll also get tons of points for buying products with the brands listed on their app.

For instance, when I upload a grocery receipt I can earn anywhere from 75 points up to 200 depending on what items and brands I purchased. For gas and other store receipts, I can earn anywhere from 5 to 25 points. Overall, it all adds up.

Once you reach over 5,000 points, you can get free yearly magazine subscriptions or gift cards.

Use the code 7JKFH when you sign up to Fetch Rewards and you’ll get 2,000 Fetch Points ($2.00 in points)

You can also refer others and earn 2,000 points ($2) yourself and your friend/family will earn 2,000 points ($2) as well.

Ibotta

So far, I built up $67 using Ibotta which is a cash back app that gives you money for uploading your grocery or store receipts. I also don’t really have a huge grocery shopping list since it’s just me, hubby, and 2 doggies.

If you’re shopping for an entire family, imagine all the cash back money you can get.

Sign up for free at Ibotta and use the code YDIGCFJ to get your $20 welcome bonus

Basically, I could redeem the $67 for cash via PayPal or get giftcards which is great! It’s enough to get a week’s worth of free groceries!

All you pretty much have to do is go into Ibotta, pick the store you plan to shop at, and start adding grocery items to your list. Once you’re done shopping, upload your receipt and you’ll get cash back for all the items on your list. Some items may require you to scan the product bar code which is not a big deal.

Savings Hack: Use Ibotta to get cash back on your other online shopping like Ulta, Amazon, Groupon, Macy’s, JCPenny, and so many more other stores. For Groupon, you’ll get 10% cash back going through Ibotta.

Saving money by cutting the cable without missing out

If you missed my last few posts, I talked about how I decided to cut the cable and went with Philo.

Philo is a streaming service where I pay $20 a month but we’re able to stream live cable network channels.

We mainly watch shows on TLC, MTV, AMC, Discovery, and a few others. It turns out Philo had all the channels we watch on there. By cutting our cable we saved over $92 on our cable bill, that’s $1,114 a year.

So far, it’s been awesome plus the savings is even better.

If you have a streaming device like a Roku, Amazon Fire Stick, or Apple TV then you can definitely try Philo out for 7 days free before committing to cutting your cable.

It’s definitely worth considering, you could be saving A LOT of money.

Sign up for free here at Philo and try it free for 7 days. (That’s what I did before cancelling the cable)

The only downside I can think of with Philo is that you won’t get your local channels but that’s where Locast comes in. It’s a non-profit service where you can stream your local channels for free as long as you have internet.

Locast offers their service in most major cities, if they don’t have your city listed then the next alternative would be to get an antenna to receive local channels for free.

Takeaway for September 2020

Man, where’s all the time going? This month flew by! We paid off over 6 figures worth of debt so far, $100,479 to be exact. *Whew

Tip 1

So this month we were able to knock out $10,000 towards my student loan. That money came out of our emergency fund. If you also have a savings fund in place, see if you have enough in there. Remember, you don’t want to keep anything more than 6 months in a savings fund especially if you have debt or want to invest.

Tip 2

If you’re trying to get out of debt, don’t deprive yourself of having fun. All you need to do is plan it well. If you have good credit, apply for cards like Capital One Venture to get those major bonus points. Use the points to get free travel on flights, hotels, cruises, vacations, statement credit, and more.

Also, use credit wisely. Stick with 1 credit card and use only 1 for all your expenses. Maybe 2 at most but it’s better that you don’t spread yourself thin. Using 1 card and paying off the balance in full will help your credit significantly plus you’ll qualify for bonus points fast.

This month we were able to get a $197 hotel stay completely free with the Capital One Venture Card.

If you don’t qualify for bonus points then create a small saving fund for your next trip. For instance, I have a category in my budget for things like “Vacation”, “Fun Money”, “Trip to Wherever”, etc. We save money each month for those categories and the next thing you know it has enough in there for a trip.

Tip 3

When booking a trip, use Rakuten first to get cash back on your trip.

For instance, we went on Rakuten to get the cash back offer for Orbitz. From Rakuten, they send you directly to Orbitz’s site where you can book your trip as usual. You’ll get cash back on your trip from Rakuten. Also, if you use Orbitz to book the travel, you’ll get something called Orbucks which is their cash back program. You’ll get double cash back opportunities for using Rakuten and Orbitz.

Tip 4

Use cash back apps and sites when you shop online. Always check Rakuten, Groupon, and Ibotta before you make a purchase online. It can mean the difference between just plainly wasting money or getting $$$ back for what you normally would do.

Tip 5

Scan your receipts for cash back, gift cards, and magazine subscriptions with apps like Receiptpal, Fetch Rewards, Ibotta, and Getupside.

Tip 6

Earn some money to get yourself some free cash or gift cards with Swagbucks. I use it mainly to play games but there’s a lot of ways to earn points on there. They have polls, questionnaires, surveys, games, watch videos, try out apps, and so much more ways to earn points. Doing this on your free time can get you some side money.

Tip 7

Cut the cable guys! If you have internet and a streaming device then you can be saving yourself over $1,000 a year just by switching from cable to Philo. You’ll get most of your cable channels. Go on Philo’s website to see if they have the network channels that you love. You can also try it out for free 7-days to see if it’s right for you or not. So far, it’s been awesome for us. It doesn’t even feel like anything’s changed, just more money in our pockets at the end of the month.

Overall, getting out of debt doesn’t have to be hard. Celebrate the small wins and still go enjoy life. Even if you earn $5 cash back or save over $90 by switching cable, it all adds up at the end of the year. Can’t wait to share what more I can find in savings with you all next month, tune in!

Read More:

Debt Free Journey – $90,479 Paid Off in 23 Months – August 2020

Debt Free Journey – $89,979 Paid Off in 22 Months – July 2020

Debt Free Journey – $89,479 Paid Off in 21 Months – June 2020

Guys, don’t let another day go by getting further in debt. Today’s the day to get started with your own debt free journey.